With Congress and the Administration still plotting their next moves in the wake of the federal courts’ vacating of SNAP rules 20 and 21, many states are pledging to regulate HFCs themselves. And while the risks of this approach, particularly the fracturing of the U.S. HVAC market, have been well documented, one aspect remains relatively unexplored. As the CFC phaseout plan began after the initial Montreal Protocol and EPA put the industry on a path to no new refrigerant being produced or imported, the price of reclaimed CFCs rose due to scarcity. As refrigerant prices went up, the cost of maintaining aging systems increased and the economics of purchasing new equipment with HFCs became more attractive. If the phasedown of HFCs proceeds state-by-state without a nationwide program, HFCs will remain cheap and available and their price steady and low. In states that enact HFC phasedown programs, this could lead operators to keep aging and leaky equipment in place longer to avoid the cost of upgrading to newer equipment with higher priced low-GWP refrigerants. Ironically, in places like California that are going beyond SNAP 20 and 21, this could theoretically lead to more leaked HFCs than if SNAP 20 and 21 were enacted federally.

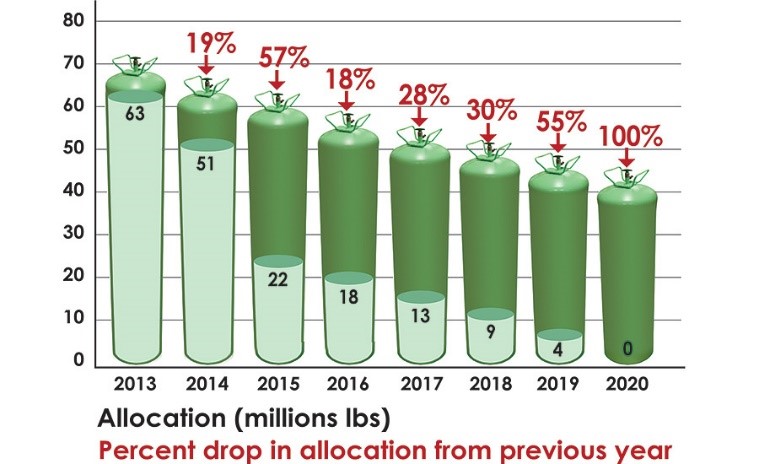

EPA is set to complete its phaseout of virgin HCFCs on January 1, 2020. As depicted in the chart below, the availability of HCFCs has decreased dramatically since 2014. Not surprisingly, the wholesale price of HCFCs such as R-22, the most prevalent HCFC used in residential air conditioning units, spiked in the following years, reaching $22/pound in 2017. This price increase caused the cost of air-conditioning unit repairs to skyrocket, as well, forcing end users to find more cost-effective alternatives. In many cases, the old R-22 machines were replaced with new units utilizing HFCs, and in some cases the older machines were retrofitted to use acceptable R-22 replacements. In any event, the federal phaseout of CFCs and HCFCs sent the proper price signals to shift the market to the newer ozone-friendly refrigerants. This mechanism worked so well that as the finish line for the phaseout approaches, the price of R-22 has actually plummeted due to weakened demand. New HFC units and retrofit refrigerants have saturated the market to the point that R-22 is far less necessary, causing its price to drop even as virgin refrigerant is virtually non-existent.

Photo credit: ACHR News – https://www.achrnews.com/articles/129671-manufacturers-assess-summer-r-22-supplies

Photo credit: https://www.pantherhvac.com/1692/repair-vs-replace-for-ac-units-the-equation-is-changing/

Unfortunately, without a similar federal program, these price signals will not exist for the next phasedown. Unit owners of HFC equipment in states like California will not see price of virgin HFCs respond in the same the way to their state’s phasedown. Prices should remain relatively cheap and so, too, will the cost to replace leaked refrigerant. In larger commercial refrigeration and comfort cooling applications refrigerant is a small portion of the overall cost of the system and end users mostly likely won’t postpone an upgrade because newer refrigerants may cost more. Large supermarket chains, in particular, often look to “future-proof” their stores and burnish their environmental records and thus may view continued use of HFCs as a liability. In smaller commercial and residential applications, however, HFC systems may see an increased lifespan due to the availability of cheap replacement refrigerant. As these systems age and their leak rates increase, more HFCs are likely to be released into the atmosphere even in states that implement phasedowns.